Flexible, customizable solutions for registered investment advisors

Access and manage client accounts, customize models to fit your clients'

needs; and benefit from improved liquidity, precision, and tax

efficiency with direct indexing of exchanged-traded funds - even provide

us with your ETF model and we can customize it into a direct indexing

solution.

Aligned with RIAs' specific needs

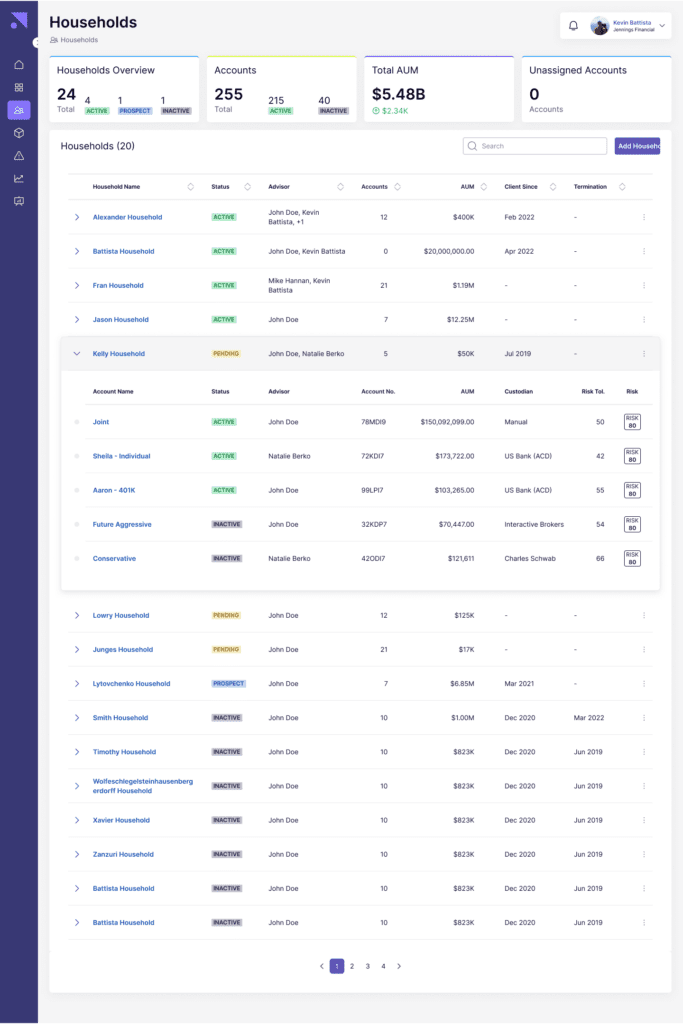

Built specifically with RIAs in mind Effortlessly manage your book of business and manage client accounts from any custodian through a centralized platform.

Built specifically with RIAs in mind Effortlessly manage your book of business and manage client accounts from any custodian through a centralized platform.  Customizable Investment Strategies Tailor and personalize exchange-traded funds (ETFs) effortlessly to match your clients' unique needs and risk preferences.

Customizable Investment Strategies Tailor and personalize exchange-traded funds (ETFs) effortlessly to match your clients' unique needs and risk preferences.  Library Of Models Explore a collection of third-party model options built by experienced portfolio managers.

Library Of Models Explore a collection of third-party model options built by experienced portfolio managers.

Tax Loss Harvesting

Our tax loss harvesting (TLH) solution is your go-to tool for managing

taxable accounts while meeting your cash flow needs in a tax friendly

manner.

Back Office Support Focus more on your clients and let us handle the monotonous administrative tasks such as custom billing schedules and client performance reporting.

OCIO Service Designed to help you prioritize the growth of your AUM while providing investment solutions that effectively manage risk, optimize returns, and control costs.

Deep Insights to Drive Client Success

Looking to give your clients clear, detailed insights into their

investment performance? Our advanced Performance platform is the

solution. It offers financial advisors a complete view of account

activity, helping your clients stay ahead. With easy-to-use tools to

measure, analyze, and compare, you can self-diagnose your investment

strategies in just a few clicks.

Exclusive Features

- Gain an in-depth understanding of client performance at three levels: household, client, and account.

- Set benchmarks with mainstream indexes or customize according to your investment strategies.

- Present visually appealing, clear performance and risk metrics that highlight the value you bring to client portfolios.

Optimize Your Investment Strategies with Precision

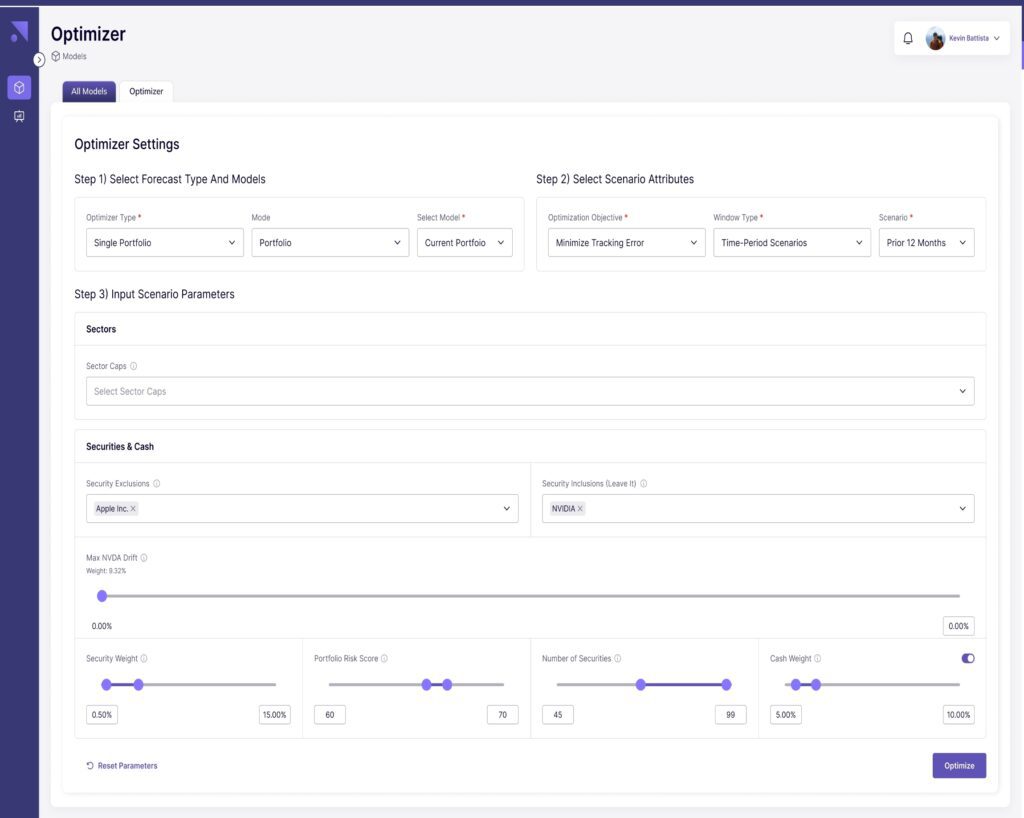

Artha's Portfolio Optimizer Tool simplifies financial decision-making

for single or multi-portfolio management. Tailor client portfolios to

meet their unique goals with our advanced portfolio optimization

features.

Key Features for Single Portfolio Optimization:

Flexible Starting Points: Use Artha's model library or upload your own portfolio.

Flexible Starting Points: Use Artha's model library or upload your own portfolio.  Custom Objectives: Optimize with 9 unique optimization objectives.

Custom Objectives: Optimize with 9 unique optimization objectives.  Tailored Constraints: Control industry exposures, include/exclude securities, set weight limits, and adjust portfolio size.

Tailored Constraints: Control industry exposures, include/exclude securities, set weight limits, and adjust portfolio size.  Risk Parameters: Align portfolios with desired risk tolerance utilizing Nitrogen's risk analytics.

Risk Parameters: Align portfolios with desired risk tolerance utilizing Nitrogen's risk analytics.

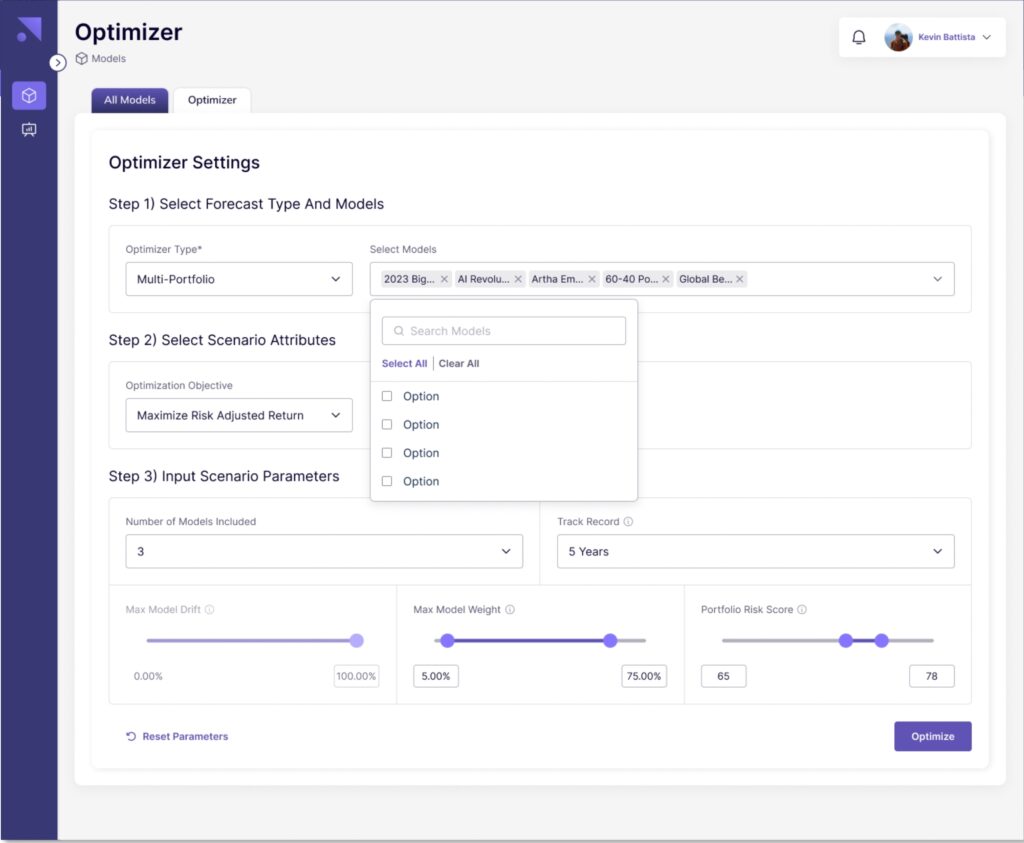

Multi-Portfolio Optimization

Blend multiple portfolios for cohesive strategies:

Strategic Blending: Optimize for return, risk-adjusted return, or diversity

Strategic Blending: Optimize for return, risk-adjusted return, or diversity  Customizable Parameters: Control portfolio inclusion, portfolio size, weights, and risk scores.

Customize your portfolio today with Artha's Portfolio Optimizer

Tool.

Customizable Parameters: Control portfolio inclusion, portfolio size, weights, and risk scores.

Customize your portfolio today with Artha's Portfolio Optimizer

Tool.